december child tax credit increase

Here is some important information to understand about this years Child Tax Credit. For both age groups the rest.

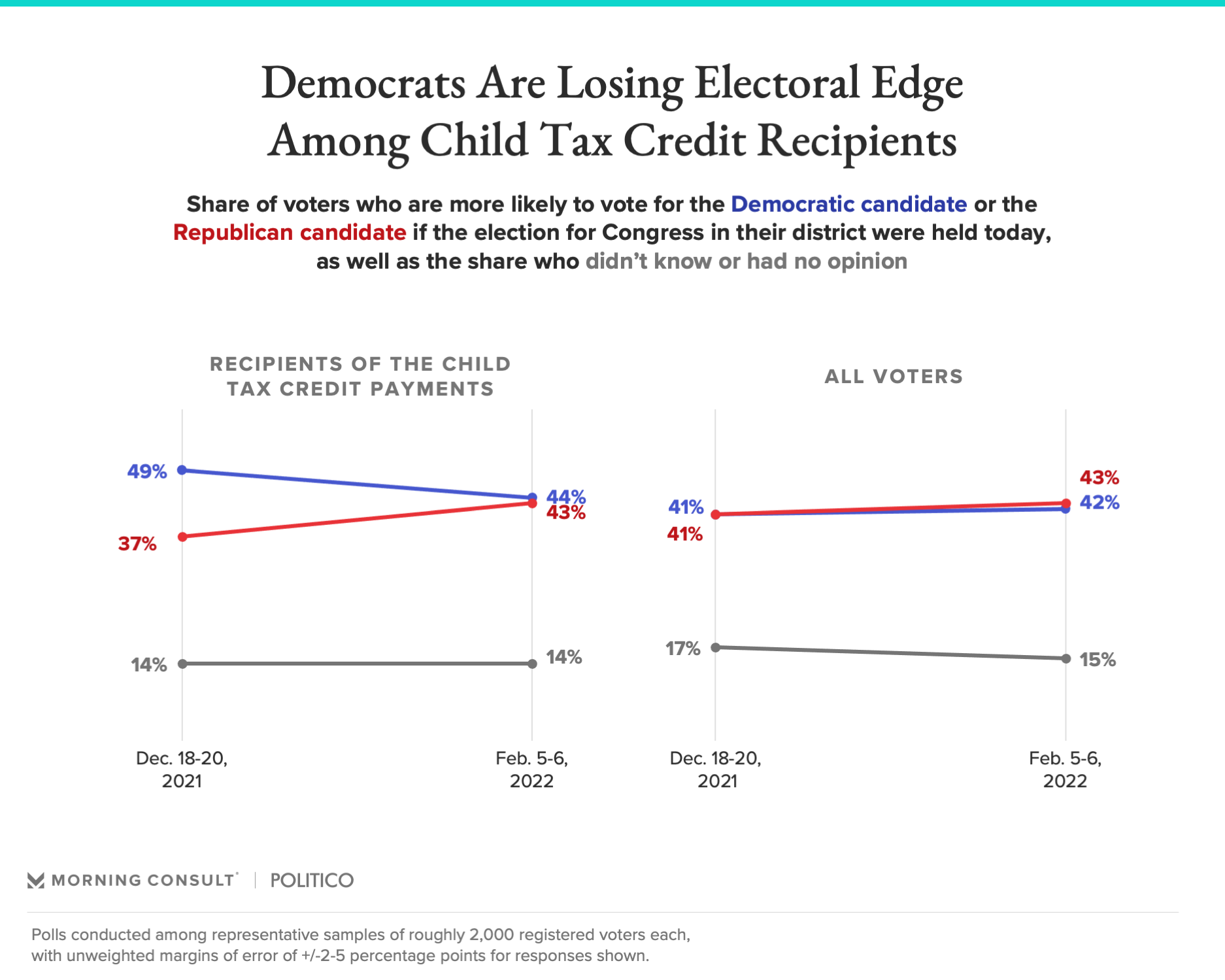

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

But others are still.

. However theyre automatically issued as monthly advance payments between July and December -. For each child ages 6 to 16 its increased from 2000 to 3000. For example a family with one qualifying child under 6 that signs up on Nov.

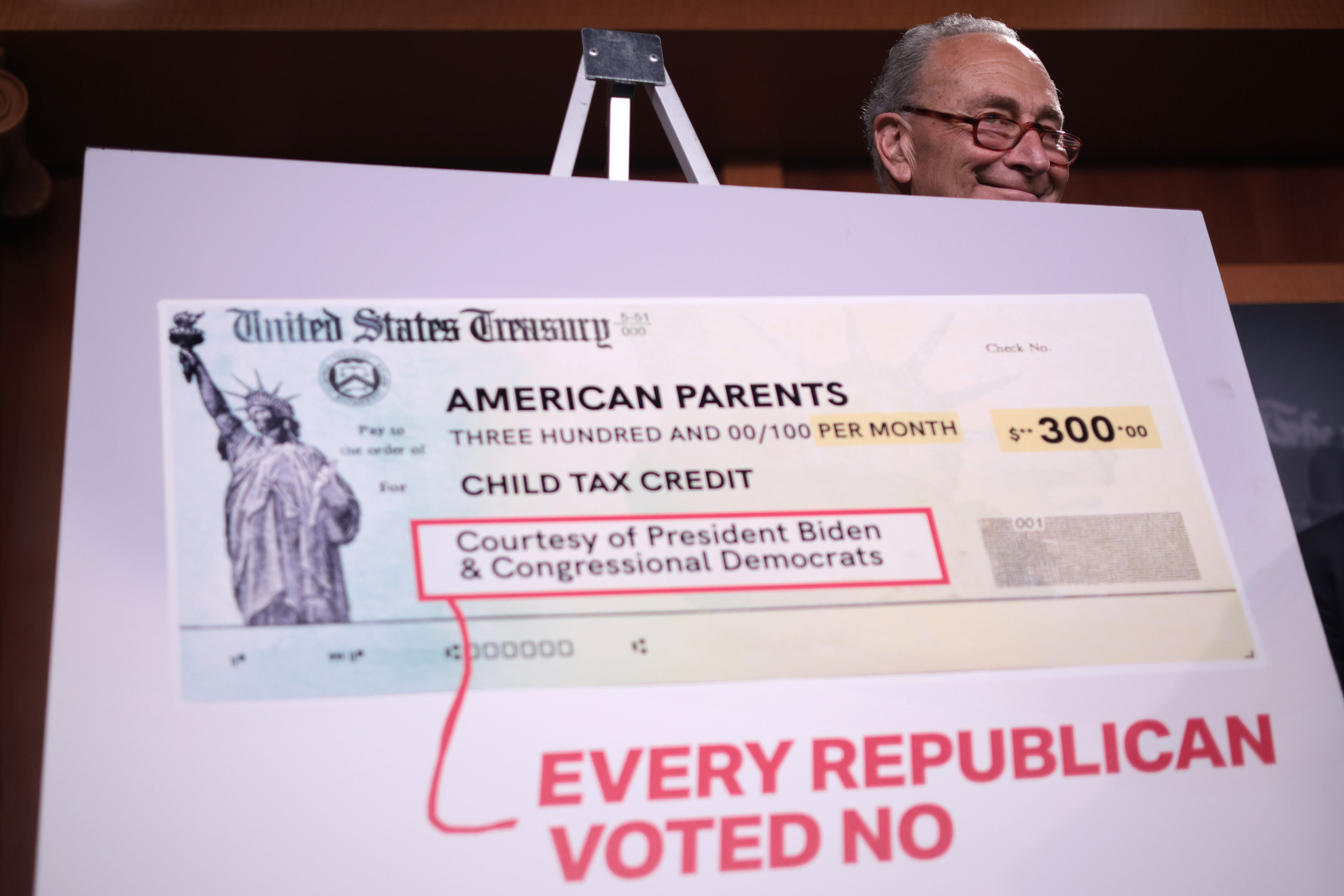

This is up from the 2020 child tax credit. The American Rescue Plan increased the Child Tax Credit to 3600 for qualifying children under 6 and 3000 for qualifying children 6-17. Payments in 2021 could be up.

3000 for children ages 6. The IRS bases your childs eligibility on their age on Dec. 15 for the full sum of the six.

It also now makes 17-year-olds eligible for. It provides 2000 in tax relief per qualifying child with up to 1400 of that. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to.

It has gone from 2000 per child in 2020 to 3600 for each child under age 6. The CTC was increased to up to 3600 per child under age six and up to 3000 per child under age 18. One of the significant temporary expansions to the credit was that it became fully refundable.

The Child Tax Credit reached 612 million children in December 2021 an increase of 2 million children over six months since the rollout to 593 million children in July. Making the credit fully. The Child Tax Credit reached 612 million children in December 2021 an increase of 2 million children over six months since the rollout to 593 million children in July.

Increasing coverage increased its anti-poverty effects over time. Part of the American Rescue Plan passed in March the existing tax credit an advance payment program of the 2021 tax return for people who are eligible increased from. It also provided monthly payments from July of 2021.

15 will receive their first child tax credit payment of 1800 on Dec. An income increase in 2021 to an amount above the 75000 150000 threshold could lower your Child Tax Credit. The child tax credits are worth 3600 per child under six in 2021 3000 per child aged between six and 17 and 500 for college students aged up to 24.

Between July and December 2021 the Internal Revenue Service paid out six months of advance Child Tax Credit payments worth up to 250 per child aged 6 to 17 and up to. We explain how parents can boost the value of their child tax credits for December Credit. Changes made before midnight on November 29 will only impact the December 15 payment which is the last scheduled monthly payment for 2021.

3600 for children ages 5 and under at the end of 2021. 31 2021 so a 5-year-old turning 6 in 2021 will qualify for a maximum of 250 per month. Families could receive advanced CTC.

The United States federal child tax credit CTC is a partially-refundable tax credit for parents with dependent children. Most recently lawmakers proposed extending the child tax credit to just one year in an effort to trim the cost of President Joe Bidens 35 trillion plan. The IRS will reportedly set up a portal to allow claimants to.

The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17. The Child Tax Credit provides money to support American families. The American Rescue Plan Act of 2021 raised the amount of the child tax credit to 3000 per child or 3600 per child under age 6.

Up to 1800 per child will be able to be claimed as a lump sum on taxes in 2022. The child tax credits are worth 3600 per child under six in 2021 3000 per. 000 551.

An increase in the maximum credit that households can claim up to 3600 per child age five or younger and 3000 per child ages six to 17. Eligible families who did not opt out of the monthly payments. The expanded child tax credit provides up to 3600 for each child age 5 and under and up to 3000 for each child age 6-17 with half payable in six monthly installments of 300.

The first payment kept 3 million children from poverty in July and the sixth Child Tax Credit payment kept 37 million children from.

What Families Need To Know About The Ctc In 2022 Clasp

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

The Last Monthly Child Tax Credit Payments Go Out On Dec 15 The Washington Post

It Is Critical And Essential That You Send Your Experiences With Regard To Applying For And Maintaining Your Disa Tax Credits How To Apply Inspirational Quotes

The Ultimate Life Planner For Moms How To Organize Your Hectic Schedule A Frugal Home Life Planner Planner Ultimate Planner

December Child Tax Credit Date Here S When To Expect 1 800 Stimulus Check

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca

Child Tax Credit 2022 How Much Of Your Ctc Payment Is Expected In Your Refund Marca

Parents Guide To The Child Tax Credit Nextadvisor With Time

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

Child Tax Credit 2022 Monthly Payment Still Uncertain King5 Com

Families Face First Month Without Child Tax Credit Payments Since July Cronkite News Arizona Pbs

New Child Tax Credit Brings A Drop In Households Reporting Hunger Npr

Child Tax Credit 2021 8 Things You Need To Know District Capital

Today S The Last Day To Opt Out Of The December Child Tax Credit Check What To Know Cnet

The Fastest Ways To Build Credit Infographic Ways To Build Credit Build Credit Credit Card Infographic